Invest in Exchange-traded Funds in Australia

Gain access to over 200 ETFs on the ASX and build your diversified portfolio.

- CHESS-sponsored trades on ETFs from $3

- Diversify into U.S. & emerging markets

- REITs, LICs, bonds and more assets available

Why invest in ETFs on the ASX with Stake?

Diversification

Access over 200 Australian exchange-traded funds to easily diversify your portfolio.

Cost savings

Investing in ASX ETFs is more cost-efficient than buying the underlying assets individually.

Simple brokerage

Buy ETFs in Australia with Stake and pay just $3 brokerage for trades up to $30,000.

CHESS sponsorship

Keep your Australian ETFs under your name and unique HIN when you buy them with Stake.

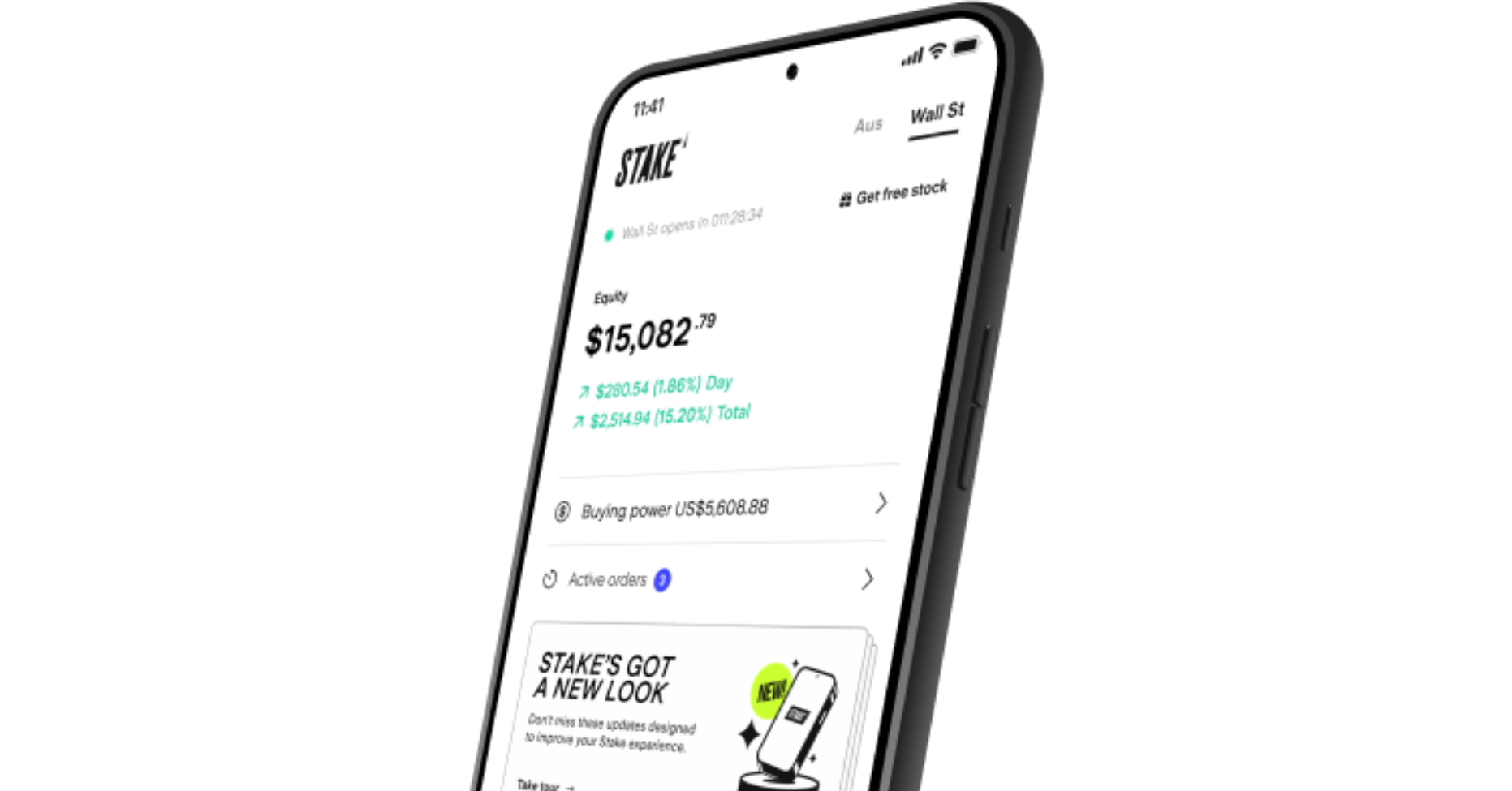

Two huge markets. One powerful platform.

Buy and sell shares, ETFs, bonds, OTC stocks, REITs, hybrid securities and more on Stake

Easy ASX investing

- 2,000+ Aussie stocks, ETFs and more

- A$3 brokerage on trades up to A$30k

- CHESS-sponsored trades

Unrivalled Wall St access

- 6,000+ U.S. stocks, ETFs, OTCs and more

- US$3 brokerage on trades up to US$30k

- Buy fractional shares with as little as US$10

Diversify with U.S. ETFs

- Access the biggest U.S. ETFs such as SPY, IVV, VOO and QQQ

- US$3 brokerage on trades up to US$30k

- Invest in exchange-traded funds with as little as US$10

How we compare

Trade fees vs Other CHESS-sponsored brokers

Trade Amount |  | CommSec | NAB | SelfWealth |

|---|---|---|---|---|

$0 - $1,000 | $3 | $5.00 (with CDIA) | $9.95 | $9.50 |

$1,001 - $5,000 | $3 | $10.00 - $19.95 (with CDIA) | $14.95 | $9.50 |

$5,001 - $10,000 | $3 | $19.95 (with CDIA) | $19.95 | $9.50 |

$10,001 - $20,000 | $3 | $29.95 (with CDIA) | $19.95 | $9.50 |

$20,001 - $25,000 | $3 | $29.95 (with CDIA) | 0.11% | $9.50 |

$25,001 - $30,000 | $3 | 0.12% (with CDIA) | 0.11% | $9.50 |

$30,000+ | 0.01% | 0.12% (with CDIA) | 0.11% | $9.50 |

Last reviewed: 25 March 2024. The information displayed in the pricing comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their websites. Please check our pricing PDF for details.

Learn more about the benefits of trading with a CHESS-sponsored platform.

The Australian Securities Exchange (ASX) requires a minimum investment of A$500 (excluding brokerage) when purchasing shares in any ASX-listed security for the first time. This is known as the ‘Minimum Marketable Parcel' (MMP) of shares. The MMP applies to all CHESS-sponsored trades.

1000's of 5-star reviews

As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between markets is easy.

I've never written an App review before, but Stake really has continued to wow me.

I started using Stake for US trading, and recently (very easily) transferred my ASX portfolio across to utilise the cheap trades.

Switched from nabtrade. Much better experience. Far cheaper.

A well designed and easy to use app to trade on the USA and AUS markets.

How to invest in ETFs in Australia

- Download Stake and sign up in minutes

- Activate Stake AUS

- Deposit funds

- Choose your ASX-listed ETF

- Place an order

Check out our comprehensive guide on how to invest in ETFs in Australia to learn more.

Why start investing in ETFs in Australia?

Exchange-traded funds vs stocks

ETFs are funds comprised of multiple underlying assets that can be bought and sold in one transaction like any other security. Meanwhile, stocks are singular assets: shares in one particular company. Learn about ETFs vs stocks and which is right for you.

There's an ETF for everyone

You have access to over 2,000 ASX securities on Stake. Aside from individual stocks, A-REITs, hybrid securities and LICs, you can also buy a variety of different Australian ETFs. These can include Australian equity, global equity, index funds, currency, fixed income and commodity ETFs. Not to mention over 1,000 U.S. ETFs on Stake Wall St.

Passive vs active Australian ETFs

Exchange-traded funds can be classified as active or passive depending on their management. Passive ETFs aim to replicate a broader index/market such as the S&P 500 or even heavy metal mining. Active exchange-traded funds seek to exceed market expectations, run by fund managers who decide which securities to include in the portfolio. Choosing between active and passive ETFs will depend on your current financial strategy and long-term investing goals. Check out our stock comparison tool and compare over 200 ASX-listed ETFs.

Keep building your investing experience

Signing up is just the beginning. Check out The Stake Desk and follow us on Instagram to stay up to date with the Australian market and more. Our Stake Academy articles in particular help you get upskilled. When you’re ready to sharpen your trading further, Stake Black is a premium membership that unlocks advanced tools and features like Course of Sales and Market Depth.

Most actively traded ASX ETFs on Stake in August

| Ticker | Company Name | Price | Market Cap | |

|---|---|---|---|---|

VAS | Vanguard Australian Shares Index ETF | $89.55 | $12.23B | Trade now |

IVV | iShares S&P 500 ETF | $46.55 | $5.9B | Trade now |

VGS | Vanguard MSCI Index International Shares ETF | $110.15 | $6.45B | Trade now |

NDQ | BetaShares NASDAQ 100 ETF | $36.21 | $3.52B | Trade now |

VDHG | Vanguard Diversified High Growth Index ETF | $58.49 | $2.06B | Trade now |

See the full list of most traded Australian shares on Stake.

Data as of 31 August 2023 for share price and market cap. The information displayed in the table is based on trade volume on Stake's trading platform for the previous month and should not be relied on to make investment decisions. This is for information purposes only and is not a recommendation to invest in the securities listed. It does not constitute financial product advice. We recommend that you do your own research and consider your own personal financial needs, objectives and circumstances before making any investment decision. Stake does not accept any responsibility for any decisions made based on the data provided.

Get 12 months of $0 brokerage

Transfer your existing ASX shares to Stake (min. A$1,000) and secure a year of free brokerage on Stake AUS trades up to A$30,000. It’s paperless, fast and only takes a few minutes to initiate.

Find out moreLearn about ETF investments in Australia

Visit the blogAustralian exchange-traded funds FAQs

Exchange-traded funds (ETFs) are one of the most popular financial assets traded by investors globally. They are versatile and generally considered low-risk investments. Some other benefits of ETFs include:

- ETFs allow investors to buy a basket of shares in a single trade - a great way to diversify your portfolio.

- ETFs are a low-cost asset to trade with a low management expense ratio (MER).

- ETFs are easy to trade and can be bought and sold during the regular ASX trading hours (or during U.S. stock exchange trading hours for U.S. ETFs).

ETFs are managed funds that exchanges, like the Australian Securities Exchange (ASX), provide to investors to buy and sell. They are passive investments that might follow an index like the ASX200, a theme or a commodity such as gold. ETFs don’t attempt to outperform the market but follow the value of the assets they track.

There are risks associated with any investment, and ETFs have some specific risks you need to be aware of. Some of the main risks that you can face trading ETFs include:

- Lack of liquidity in volatile markets.

- Any changes that a government or regulator could introduce which impacts the value of securities in which the ETF is invested in.

- Some ETFs may use OTC derivatives that have higher exposure to counterparty risk.

- ETFs taxation treatment can vary differently to shares, so it's important to take advice from a taxation adviser for your own financial circumstance.

Australian ETFs pay dividends just like any dividend-paying stock. However, ASX ETFs typically pay out dividends on a quarterly basis, with the payouts from all relevant stocks pooled together. Like individual stocks, the dividends can be paid out through the issuance of additional stock or cash. Learn about some of the top dividend ETFs in Australia.

The minimum investment required to buy ETFs in Australia is $500. Stake is a CHESS-sponsored platform and this means that there’s a minimum marketable parcel under your own HIN. Once you already hold shares of a specific ETF and want to buy more, there’s no minimum purchase size.

The largest exchange-traded fund on the ASX is the Vanguard Australian Shares INDEX ETF ($VAS), with $12.90b of assets under management (AUM) as of 19 September 2023. Learn more about the top 10 Vanguard ETFs in Australia.

ETFs can make a great long-term investment and have historically shown a higher rate of success when held over a longer term compared to holding individual stocks. When you invest in ETFs over a long period of time, this allows you to compound any earnings received from dividends and cut down on costs like brokerage fees.

Get started with $10 on us

Sign up and fund Stake AUS to claim.

Transfer existing ASX stocks and you could also trade for free.